QuickBooks® Aging RfP RTP

The Best Solution for Aging Request for Payment Real-time Payments Processing in QuickBooks®

Today Payments is an Authorized Developer of Intuit offering a highly robust app that supports both QuickBooks’ desktop and online customers, provide merchants with the tools they need so they can focus more time on their customers and businesses, and less time on data entry. "Our Integrated payment solutions can save a typical small business owner more than 180 hours each year"

"Our Integrated payment solutions can save a typical small business owner more than 180 hours each year"See

the features

QuickBooks® ACH, Cards, FedNow and Real-Time Payments

- Payment processing for all QuickBooks desktop, Pro, Premier, Enterprise and also QBO QuickBooks Online Our software is designed for simplicity and ease-of-use.

- ~ Automate Account Receivable Collection

- ~ Automate Account Payable Payments

- ~ One-time and Recurring Debits / Credits

Secure QB Plugin payment processing through QuickBooks ® specializes in the origination of moving money electronically.

Ask about our special:

Request for Payments

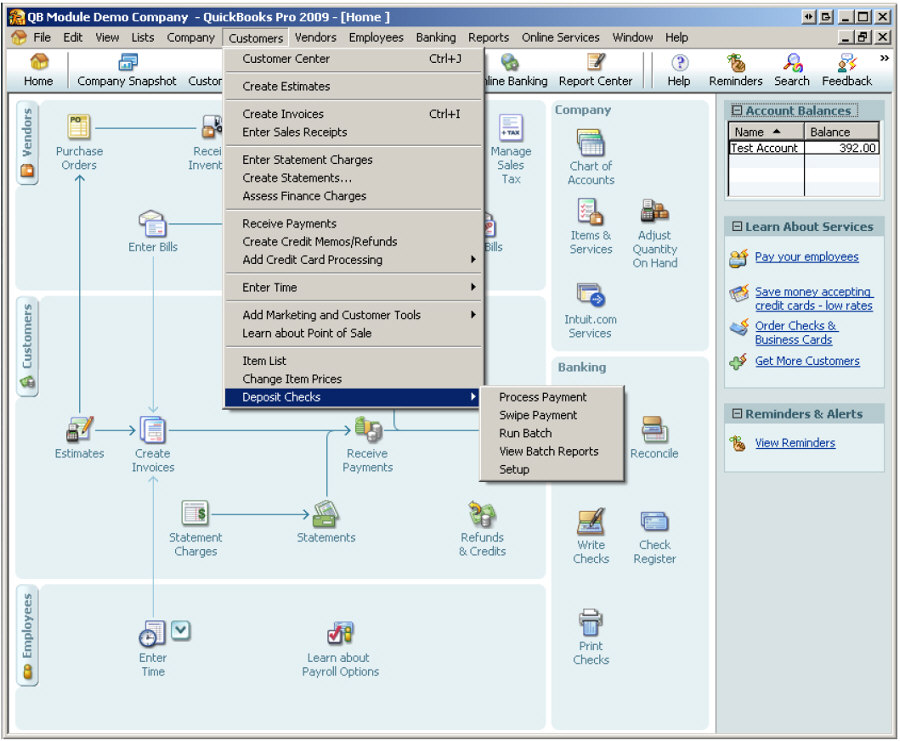

Tracking the aging of digital invoicing Request for Payments (RfP) with real-time payments in QuickBooks Online (QBO) involves integrating the real-time payment information into your spreadsheet. Here's a guide on how you can structure your spreadsheet:

Spreadsheet Columns:

- Vendor/Requester Name:

- Identify the entity or individual making the payment request.

- Invoice/Request Number:

- Unique identifier for each digital invoice or payment request.

- Invoice/Request Date:

- Date when the digital invoice or payment request was generated.

- Due Date:

- The date by which the payment is expected.

- Amount Requested:

- The total amount requested for payment.

- Real-Time Payment Status:

- A column to indicate whether the payment was received in real-time or not.

- Payment Date:

- Date when the payment is made.

- Days Outstanding:

- Automatically calculated field (Payment Date - Due Date) to determine how many days the payment is overdue.

Spreadsheet Formulas:

- Days Outstanding Formula:

- Create a formula in the "Days Outstanding" column to calculate the number of days the payment is overdue. Use a formula like: =IF(ISBLANK([Payment Date]), TODAY() - [Due Date], [Payment Date] - [Due Date]).

Aging Buckets:

- Current (0-30 days):

- Use conditional formatting to highlight payments that are within the current period.

- 30-60 Days:

- Apply conditional formatting to highlight payments that are 30 to 60 days overdue.

- 60-90 Days:

- Apply conditional formatting to highlight payments that are 60 to 90 days overdue.

- 90+ Days:

- Apply conditional formatting to highlight payments that are more than 90 days overdue.

Summary Section:

- Total Amount Outstanding:

- Sum the amounts for all outstanding digital payment requests.

- Average Days Outstanding:

- Calculate the average number of days outstanding for all payment requests.

Visualization:

- Graphs/Charts:

- Create charts to visually represent the aging of digital payment requests over time.

Example Structure:

|

Vendor |

Invoice Number |

Invoice Date |

Due Date |

Amount Requested |

Real-Time Payment |

Payment Date |

Days Outstanding |

|

ABC Inc |

INV001 |

2023-01-15 |

2023-02-15 |

$1,000.00 |

Yes |

2023-02-20 |

=IF(ISBLANK(F2), TODAY() - D2, F2 - D2) |

This structure allows you to track and manage the aging of digital payment requests with a specific column indicating real-time payments. Customize it based on your specific needs and the level of detail you require for your financial tracking. Regularly update the spreadsheet with new payment requests, payment dates, and any other relevant information.

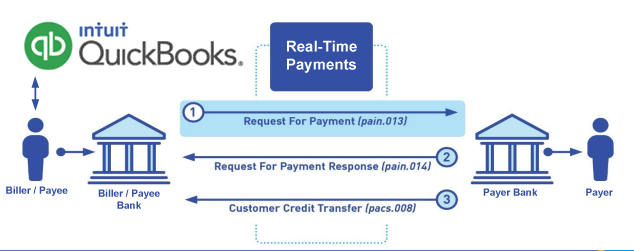

Call us, the .csv and or .xml Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-Time Payments to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) show how to implement Create Real-Time Payments Request for Payment File up front delivering message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continuing through a "Payment Hub", will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

Our in-house QuickBooks payments experts are standing ready to help you make an informed decision to move your company's payment processing forward.

Pricing with our Request For Payment Professionals

1) Free ISO 20022 Request for Payment File Formats, for FedNow and Real-Time Payments (The Clearing House) .pdf for you manually create "Mandatory" (Mandatory data for completed file) fields, start at page 4, with "yellow" highlighting. $0.0 + No Support

2) We create .csv or .xml formatting using your Bank or Credit Union. Create Multiple Templates. Payer/Customer Routing Transit and Deposit Account Number may be required to import with your bank. You can upload or "key data" into our software for File Creation of "Mandatory" general file.

Fees = $57 monthly, including Support Fees and Batch Fee, Monthly Fee, User Fee, Additional Payment Method on "Hosted Payment Page" (Request for file with an HTML link per transaction to "Hosted Payment Page" with ancillary payment methods of FedNow, RTP, ACH, Cards and many more!) + $.03 per Transaction + 1% percentage on gross dollar file,

3) Payer Routing Transit and Deposit Account Number is NOT required to import with your bank. We add your URI for each separate Payer transaction.

Fees Above 2) plus $29 monthly additional QuickBooks Online "QBO" formatting, and "Hosted Payment Page" and WYSIWYG

4) Above 3) plus Create "Total" (over 600 Mandatory, Conditional & Optional fields of all ISO 20022 Pain .013) Price on quote.